Low credit score refinance home loans

Get Offers From Top Lenders Now. Apply Now With Quicken Loans.

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

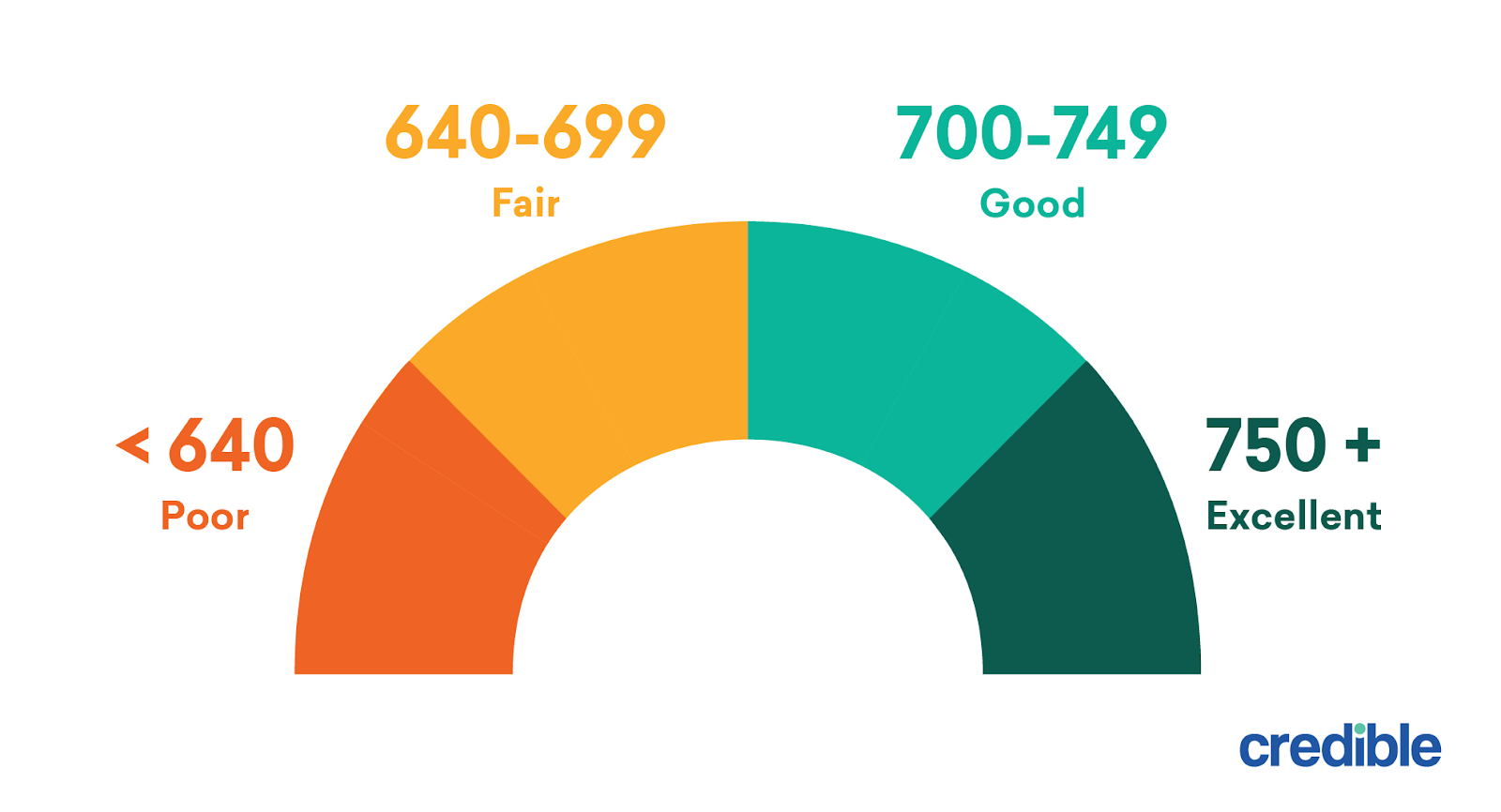

Excellent credit Borrowers with a credit score in this range can typically expect to get the best possible rates on their loans.

. Youll need to have a minimum credit score of at least 620 if you want to take a cash-out refinance in most scenarios. All of Carringtons government-backed loan options which include its FHA USDA and VA mortgages allow credit scores as. Compare Mortgage Refinance Offers From The Top 5 Rated Lenders In The Country.

Ad No Monthly Payments. Non-QM Loan Cash Out Refinance with Credit Scores in the 500s. Ad Compare Mortgage Options Calculate Payments.

The minimum credit score for this mortgage is 550. In general a credit score of between 670 and 739 is considered good. Apply Today Payoff Your Debt.

Top Lenders in One Place. Ad Compare the Top 5 Best Refinance Companies for 2022. Got Bad Credit But Need A Cash-Out Mortgage Refi.

Browse through our frequent homebuyer questions to learn the ins. Minimum credit score needed. It is vital that you understand your whole credit profile not just.

Interest rates are near all-time lows. Special Offers Just a Click Away. Shared Equity May Be The Best Solution.

Use your discretionary funds to pay down your credit card debts which often have the largest impact on a credit score for many homeowners. Ad Compare Best Debt Consolidation Loans Companies 2022. Ad Find Mortgage Lenders Suitable for Your Budget.

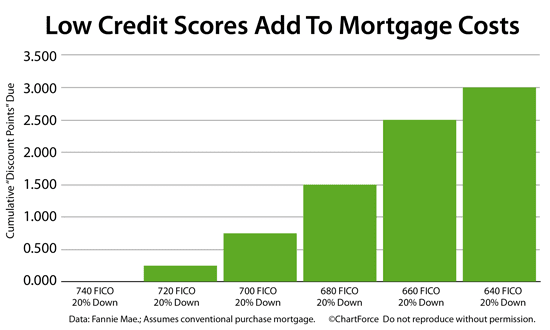

As you can see with your current score of 520 you could be charged about 958. Most lenders prefer a credit score that falls in the range of 670 to 739 or higher but you may be able to get a loan with a lower credit score. Receive Your Rates Fees And Monthly Payments.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. But its very difficult to find lenders that allow such low scores. Apply a lump-sum toward the homes mortgage balance.

Conventional loans FHA loans VA loans and Jumbo loans Terms 8 29 years including 15-year and 30-year terms Credit needed Typically requires a 620 credit score but will. Why Citizens is the best home equity line of credit for low loan amounts. Get The Service You Deserve With The Mortgage Lender You Trust.

Compare Mortgage Refinance Offers From The Top 5 Rated Lenders In The Country. Refinancing your home loan with a low credit score isnt ideal since you will likely pay a higher interest rate than youve seen advertised which can cost you thousands in the long run. Keep your credit card balances.

Get Your Estimate Today. When you want an FHA loan cash out refinance we can often accept a minimum credit score of 550. Technically you can refinance an FHA loan with a credit score as low as 500.

Purchase or refinance your home with an FHA loan. Compare offers from our partners side by side and find the perfect lender for you. Ad Compare the Best Refinance Mortgage Lender that Suits Your Needs with No Closing Costs.

With the minimum credit score to refinance of 580. Ad Compare the Top 5 Best Refinance Companies for 2022. Let Flagstar Bank Assist You In Finding The Right Mortgage Solution Rate Or Program.

Call us at 303-900-3869 email. Prior to the covid-19 pandemic these alternative loan types were available as low as 500 score. In practice you typically need a.

Your LTV ratio determines the minimum credit score required for a rate-and-term refinance on a mortgage backed by the. Ad Our Mortgage Specialists Are Ready To Craft A Home Refinancing Solution For You. Loans backed by the FHA typically have less stringent requirements and allow borrowers to qualify for refinancing with scores as low as 500 depending on the program.

Rocket Mortgage will do a VA cash-out refinance with a. These minimum credit scores are lower than scores you may see required by other lenders. Scores between 580 and 669 are considered fair and anything below 580 is considered poor.

Another method for refinancing with a low credit score is to lower the loan amount you are trying to obtain. Top Lenders in One Place. You can get one with a down payment as low as 35.

You can do this by placing. We will take the time to look at your situation from every angle to make sure that you get the best deal on the market. Compare Quotes See What You Could Save.

Can I Refinance My Mortgage With Bad Credit Nerdwallet

Minimum Credit Scores For Fha Loans

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What C Loans For Bad Credit Bad Credit Mortgage Credit Score

Can You Get A Home Loan With A 550 Credit Score Credit Sesame

Current Mortgage Interest Rates September 2022

640 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

Credit Score Under 740 Prepare To Overpay On Your Mortgage

Low Income Mortgage Loans For 2022

Can You Get A Home Loan With A 550 Credit Score Credit Sesame

Refinancing With Bad Credit 6 Questions To Ask Zillow

3 Options For Refinancing With Bad Credit Rocket Mortgage

500 Credit Score Mortgage Lenders Great Options

How To Get A Bad Credit Home Loan Lendingtree

What Is A Good Credit Score To Buy A House Or Refinance

Options For Refinancing Your Home With Bad Credit Forbes Advisor